What exactly is compound interest?

Simply put, it’s the interest your interest makes for you.

Still interested?

In this edition of THE FINE PRINT, we demystify compound interest, the set-it-and-forget-it principle that makes your money work for you.

For our purposes, interest refers to the money you earn in an investment account.

Let’s say you invest five dollars. Each of those dollars goes off, does its thing, and a year from now brings you back five cents. (This would be a rate of return of 5%, which is actually pretty good). Your money just made you a quarter. It isn’t much, but 1) you didn’t have to do anything to earn it, aside from basically letting it be, and 2) imagine if, instead of starting with $5, you started with $5,000, or $50,000.

And that’s not even the fun part.

Compound interest is what happens when those little interest dollars grow up and start making little interest dollars of their own. And those dollars make more dollars, who make their own dollars, and so on and so forth. It’s like an infestation, except you can go on vacation with it, buy a house, or send your kid to college.

It pays to start early

Compound interest requires only two conditions: money (your initial investment) and time (the more of this the better).

Here’s a quick story about two investors, Jack and Jill.

Jill invests $200 a month for 10 years, between the ages of 25 and 35.

Jack invests $200 a month for 30 years, from the time he’s 35 until he’s 65.

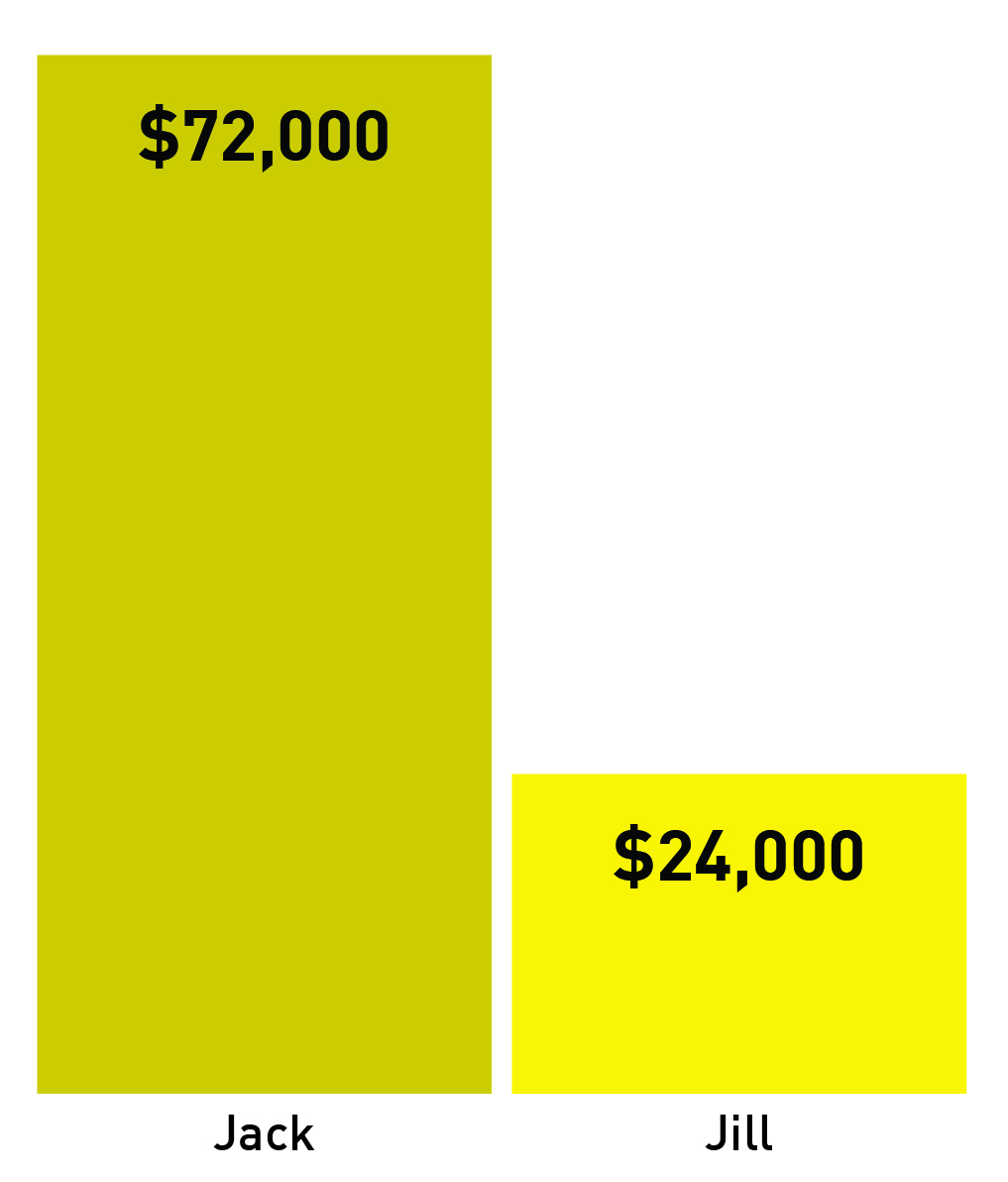

All told, Jill invests $24,000. Jack invests $72,000.

FIGURE 1. In which Jack and Jill invest.

VALUE OF CONTRIBUTION

So far, Jack’s ahead by a mile, but whose investment will be worth more money by the time they’re both 65?

(Drum roll...) Jill’s!

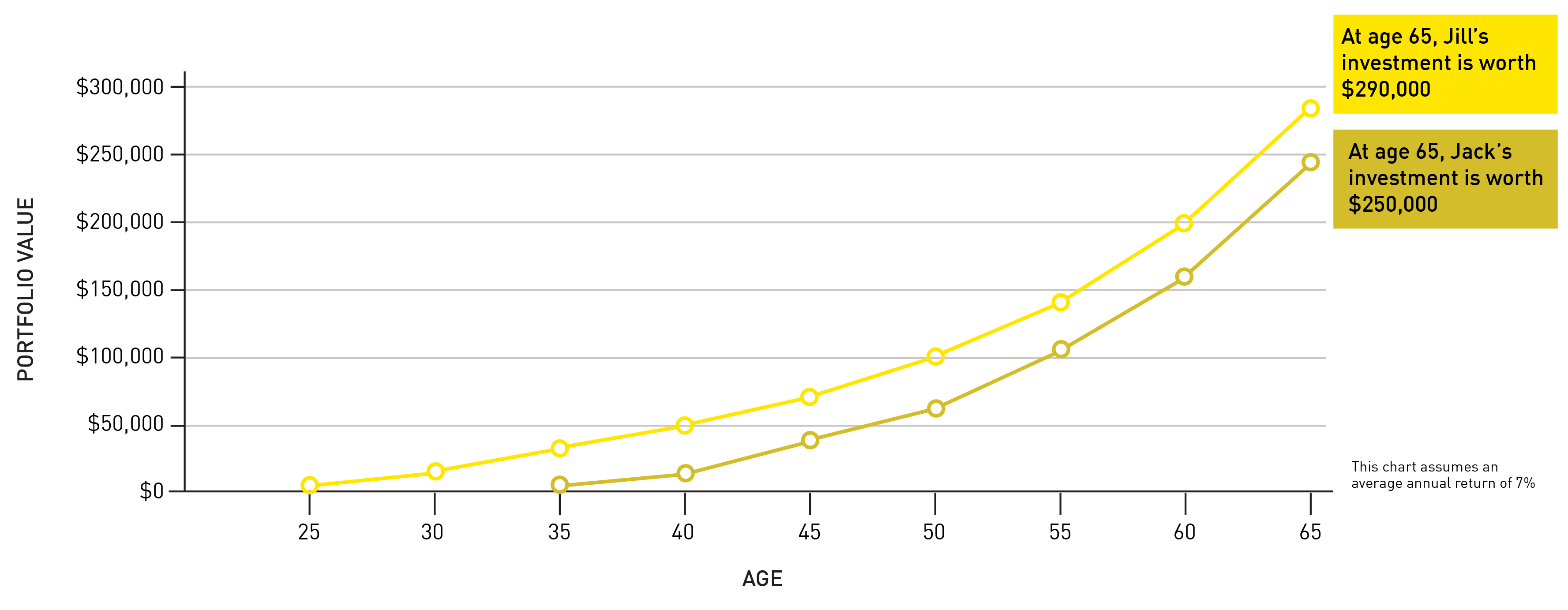

FIGURE 2. In which Jill looks back at Jack, pityingly, in the distance.

VALUE OF INVESTMENT AT AGE 65*

Jill’s total contribution was smaller, but she gave her money time to grow, and that made all the difference. The good news for you is that you’ll never have as much time ahead of you as you do right now.

So, what are you waiting for? Book a 30-minute meeting with a wealth specialist from Lawyers Financial and empower your dollars to go forth and multiply.

*The chart that shows the value of Jack and Jill’s investments at age 65 assumes a 7% annualized rate of return. That rate of return approximately matches the average return of the S&P 500 index—7.2% annualized, including reinvested dividends—from the time it adopted 500 stocks in 1957 through June 29, 2023. The assumed rate of return on your investments depends on many factors, including your time horizon and tolerance for risk.